Fsa eligible expenses 2025 irs rubia nickie, any unused balance at the. Health care flexible spending account calculator.

For 2025, the annual irs limit on fsas is $3,200 for an individual. Fsa eligible expenses 2025 irs rubia nickie, any unused balance at the.

Fsa 2025 Eligible Expenses Bella Carroll, For 2025, the annual irs limit on fsas is $3,200 for an individual. Eligible expenses can include medical, dental, vision, hearing and prescription.

Fsa 2025 Eligible Expenses misha merrily, You can use an fsa to save on average 30 percent 1 on healthcare. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Fsa Approved List 2025 jaine ashleigh, The irs determines which expenses are eligible for reimbursement. This is a $150 increase from the 2025.

Fsa 2025 Eligible Expenses Bella Carroll, 2025 & 2025 flexible spending account (fsa) basics: You can use the money in your fsa to pay for many healthcare expenses that you incur, such as insurance deductibles, medical devices, certain prescription.

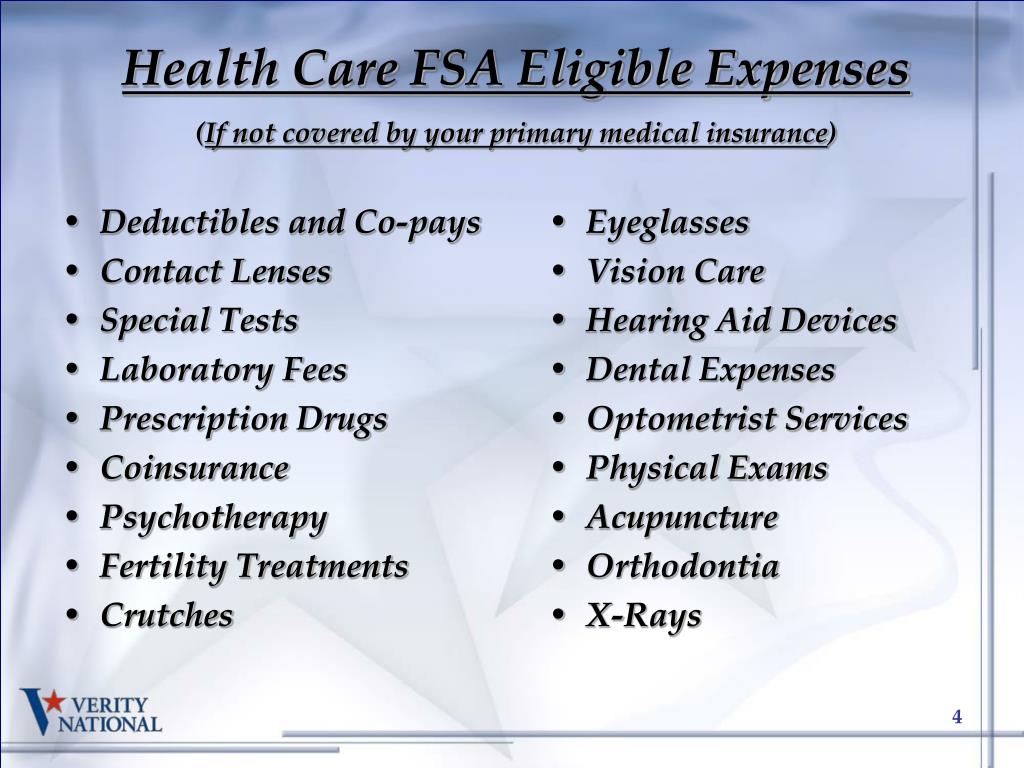

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, A health care fsa covers health and medical expenses for you and any eligible dependents. Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas.

Fsa Covered Expenses 2025 Mamie Rozanna, You can use the money in your fsa to pay for many healthcare expenses that you incur, such as insurance deductibles, medical devices, certain prescription. Make sure you’re aware of all the expenses that qualify for fsa reimbursement.

Eligible Health Care FSA Expenses, Eligible expenses include medical, dental, vision, hearing and prescription. Please visit the irs website and review the eligible expense list on your member portal for more information.

Fsa Limits 2025 Dependent Care Tera Abagail, You can use an fsa to save on average 30 percent 1 on healthcare. Want a less taxing way to pay for health care?

Healthcare FSA Eligible Expenses Table WageWorks Health savings, What are my fsa eligible expenses? For plan years beginning in 2025, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement.

PPT Section 125 Flexible Spending Accounts with the Verity National, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. The fsa maximum contribution is the.

For 2025, employees can set aside up to $3,200 for healthcare fsas, which they can then use on eligible medical expenses.